The Financial Action Task Force (FATF) concluded its sixth and final plenary under the presidency of T. Raja Kumar of Singapore on June 28, 2024. Delegates from over 200 jurisdictions and observers from international organizations gathered in Singapore for three days of intensive discussions on critical issues related to money laundering (ML), terrorism financing (TF), and proliferation financing (PF).

We’ve summarized the key developments:

- Changes to the grey list.

- Revised International Cooperation Review Group (ICRG) criteria.

- Assessment methodology revisions.

- Mutual evaluation preparations.

- Strategic initiatives.

- Priorities of the incoming Mexican presidency.

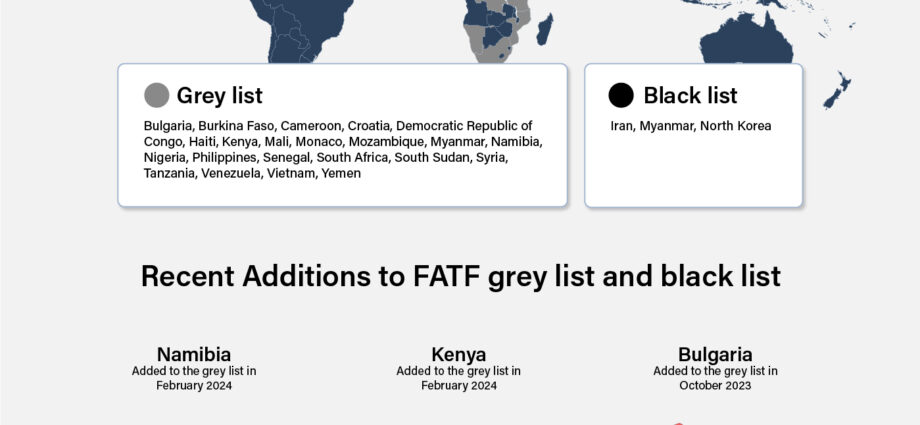

Changes to the grey list

Monaco and Venezuela added to the grey list

Monaco

Monaco, which has the highest concentration of millionaires and billionaires in the world, was added to the grey list due to insufficient progress in combating illicit financial flows. This decision comes after a review by MONEYVAL in December 2022, which revealed the following insufficiencies:

- A misalignment in Monaco’s investigative and prosecutorial practices concerning ML, especially a shortfall in tackling complex cases commensurate with its risk exposure.

- A need to amplify the country’s measures in prioritizing ML cases and enhance the effectiveness of seizing, confiscating, and recuperating proceeds derived from financial crimes.

- A lack of efficiency regarding beneficial ownership checks, specifically in ensuring the fitness of entities.

- An inadequate sanctions regime that lacks sufficient severity, deterrent impact, and is often enforced after unjustifiable delays.

While Monaco had made some progress since 2022 in identifying ML/TF threats – adopting nine laws to toughen its rules and boost its anti-money laundering (AML) body, the Autorité Monégasque de Sécurité Financière (AMSF) – there were still significant gaps in the country’s AML regime.

Monaco’s government has stated its commitment to being removed from the grey list, saying, “The principality confirms its determination to implement the latest FATF recommendations outlined in the declaration, in accordance with the planned deadlines.”

Venezuela

In early 2022, an assessment team visited Venezuela to prepare the country’s mutual evaluation report (MER). The team raised concerns about the ML risks associated with the nation’s large informal economy, which includes illegal mining. They also highlighted terrorist financing threats linked to the close economic alliance between Caracas and Tehran. Consequently, Venezuela has been added to the grey list and has agreed to implement its FATF action plan, which includes:

- Strengthening its understanding of ML/TF risks, including in relation to terrorist financing and legal persons and arrangements.

- Ensuring the full range of financial institutions (FIs) and designated non-financial businesses and professions (DNFBPs) are subject to AML/CFT measures and risk-based supervision.

- Ensuring that adequate, accurate, and up-to-date beneficial ownership information is accessible promptly.

- Enhancing the resources of the financial intelligence unit (FIU) and improving competent authorities’ use of financial intelligence.

- Enhancing the investigation and prosecution of ML/TF.

- Ensuring that measures to prevent the abuse of non-profit organizations (NPOs) for terrorist financing are targeted, proportionate, and risk-based and do not disrupt or discourage legitimate activities within the NPO sector.

- Implementing targeted financial sanctions related to terrorism financing and proliferation financing without delay.

Jamaica and Türkiye removed from the grey list

Jamaica

In February 2020, Jamaica was placed on the grey list due to various deficiencies. These included the need to prevent legal persons and arrangements from being misused for criminal purposes, as well as the prompt implementation of targeted financial sanctions for terrorist financing. Since then, Jamaica has worked to implement its 13-point action plan by:

- Developing a more comprehensive understanding of its ML/TF risk, including all FIs and DNFBPs in its AML/CFT regime.

- Taking measures to prevent misuse of legal entities.

- Increasing the use of financial information.

- Implementing targeted financial sanctions for terrorist financing without delay.

As a result of their progress, Jamaica has been removed from the grey list. Looking forward, Jamaica’s Minister of Finance and the Public Service, Dr. the Hon. Nigel Clarke, has said that before the end of 2025, Jamaica will be focusing on amending or introducing new laws to:

- Regulate virtual assets and virtual asset providers.

- Make the registration of non-profit organizations mandatory.

- Promulgate regulations that address certain targeted financial sanctions related to proliferation.

Türkiye

In October 2021, Turkey was added to the grey list for failing to adequately supervise banking, real estate, and other sectors vulnerable to ML, including cryptocurrency. Since then, the country has committed to implementing its FATF action plan by enhancing AML/CFT supervision, imposing strong penalties for violations, and improving financial intelligence use.

As part of its efforts to enhance the country’s AML regime, the Turkish parliament passed a new cryptocurrency law on June 26, 2024. The law mandates that crypto asset service providers must obtain permission from the Capital Markets Board (SPK) before they can begin operating. Existing service providers will need to apply for a license within one month of the law being enacted, or they must declare their decision to liquidate within three months. The bill also includes definitions relating to crypto assets and providing crypto asset-related services.

After being removed from the grey list, Turkish Vice President Cevdet Yilmaz highlighted the significant positive effects on the country’s financial and real estate sector. In particular, he hopes the development will substantially bolster international investors’ confidence in Türkiye’s economic infrastructure. Moreover, Yilmaz pointed out that the heightened interest in Turkish lira assets, spurred by increased national capital inflows, would further hasten the disinflation process.

Revised International Cooperation Review Group (ICRG) criteria

New criteria have been approved for selecting countries for examination by the International Cooperation Review Group (ICRG). This process aims to identify countries with deficiencies in their AML/CFT frameworks that pose risks to the global financial system. The FATF may list these countries as either “grey” or “black”, indicating different levels of concern. The revised criteria are set to be implemented in the forthcoming assessment cycle.

This update to the prioritization criteria is part of a series of measures intended to refine the FATF’s listing procedure and make it more equitable and transparent. The watchdog also recognized the unique challenges the least developed countries faced in meeting its standards. By considering these challenges, the FATF aims to provide a fairer assessment framework that acknowledges the varying capacities of countries to address AML/CFT deficiencies.

Methodology revisions

The global watchdog also agreed on how countries will be assessed for their adherence to the updated FATF Standards regarding asset recovery and international cooperation. These standards were revised and adopted in October 2023 to enhance the global fight against financial crimes. Moving forward, each country must demonstrate a commitment to several key practices to ensure compliance with these revised standards:

- First and foremost, countries are required to show they are making asset recovery a priority. This involves the competent authorities actively identifying and tracing properties involved in criminal activities. Moreover, these authorities must be successful in obtaining and enforcing confiscation orders. By doing so, they can effectively deprive criminals of their ill-gotten gains.

- Additionally, countries are expected to facilitate constructive and timely international cooperation. Given the often cross-border nature of financial crimes, this aspect is crucial for the efficient recovery of assets and the broader effort to combat such crimes.

These measures aim to fortify global financial security by ensuring countries are equipped and willing to tackle the challenges associated with asset recovery and international legal cooperation. Compliance with these revised standards will be assessed regularly to guarantee countries remain committed to these objectives.

Mutual evaluation preparations: India and Kuwait

Two MERs were discussed in detail at the plenary. Regarding India’s report, the watchdog praised its high technical compliance with FATF standards and acknowledged the effectiveness of its regime in areas like understanding ML/TF risks, international cooperation, and the use of financial intelligence. However, it was pointed out that India could enhance its efforts by:

- Supervising and implementing preventive measures in certain non-financial sectors.

- Improving the timeliness of ML/TF prosecutions.

- Tailoring CTF measures for the non-profit sector to better match a risk-based approach.

On the other hand, Kuwait’s evaluation concluded that the country has a robust legal and supervisory framework to combat ML/TF/PF. Yet, there are significant weaknesses in achieving effective outcomes. Kuwait is advised to:

- Deepen its understanding of ML/TF risks.

- Strengthen TF investigations and prosecutions.

- Ensure the quick legal freezing of terrorism or weapons of mass destruction-related assets.

- Enhance preventive measures against legal person misuse while protecting the non-profit sector from TF risks.

Both countries’ reports are pending publication following the FATF’s final quality and consistency review.

The State of Compliance 2024

From developing a more strategic AML roadmap to a layered approach to sanctions compliance, this four-part webinar series provides compliance professionals with access to our Regulatory Affairs team and an array of industry experts ready to share the latest trends and best practices.

Strategic priorities

Existing initiatives

Being the final plenary under the FATF’s Singapore presidency, an update was given relating to each strategic priority that T. Raja Kumar initially set out in July 2022.

- DNFBP compliance review: The FATF has completed its review of the measures that its members have in place to prevent gatekeepers (such as accountants, lawyers, real estate agents, and trust and company service providers) from being used to facilitate ML/TF. The FATF will publish the findings of this review in July 2024.

- Virtual assets standards update: The FATF will publish its fifth annual update on jurisdictions’ progress in implementing the FATF Standards on virtual assets and virtual asset service providers (VA/VASPs). While some progress has been made since the last update, most jurisdictions are only partially or not compliant with the standards, leaving VAs and VASPs vulnerable to misuse. The FATF is calling on all jurisdictions to swiftly and completely implement the requirements and will continue to monitor the situation. The fifth annual update will also be published in July 2024.

- Payment transparency revision: The FATF is updating its standards to reflect changes in cross-border payment systems, industry standards (especially ISO 20022), and ensure AML/CFT compliance. The plenary also discussed the results of a public consultation on draft amendments, aiming to make cross-border payments faster, cheaper, and more transparent. As a result, it was determined that further discussions with relevant experts are needed before finalizing the amendments.

- Global network cooperation: During the FATF-FSRB Annual High-Level Meeting, the representatives discussed progress in implementing the 2022 Strategic vision for the Global Network. As a result, they agreed on three priorities for the coming year:

- Increasing FATF-Style Regional Bodies’ (FSRB) participation in FATF work.

- Preparing for new mutual evaluations.

- Strengthening regional AML/CFT expertise.

- Women in FATF and the Global Network Initiative: As part of the Women in FATF and the Global Network (WFGN) initiative, Ms. Indranee Rajah, Minister in the Prime Minister’s Office and Second Minister for Finance and National Development, launched the e-book “Breaking Barriers: Inspiring the Next Generation of Women Leaders.” The e-book is part of the Singapore Presidency’s efforts to support women leaders and complements the multicultural mentoring program and other initiatives to strengthen the FATF and Global Network community.

Priorities of the incoming Mexican presidency

In February 2024, Ms Elisa de Anda Madrazo of Mexico was announced as the successor to T. Raja Kumar as president of the FATF. Ms de Anda will assume the FATF Presidency from July 1, 2024, to June 30, 2026. In addition to the three priorities mentioned above, Ms de Anda emphasized the following areas of focus for the Mexican presidency:

- Promoting financial inclusion by implementing risk-based standards with a proportional approach.

- Assisting in effectively implementing revised FATF standards, particularly focusing on asset recovery, beneficial ownership, and virtual assets.

Next steps

Compliance staff should ensure they are familiar with the outcomes of the June plenary – particularly relating to any upcoming MERs in countries they operate in. Regarding the changes to the grey list, firms must update the risk scores of relevant countries, with appropriate levels of due diligence being administered as required going forward.

Dates related to forthcoming guidance issued by the FATF should also be noted. Such guidance will help shape and inform the future regulatory approach national bodies take.

The next FATF plenary is due to take place in October 2024.

Previous plenary coverage from ComplyAdvantage can be found here:

The State of Financial Crime 2024

Download our annual state of the industry report, built around a global survey of 600 senior financial crime decision makers. Packed with practical tips from our Regulatory Affairs experts, the report explores the major trends and topics set to shape the year in compliance.

Originally published 01 July 2024, updated 01 July 2024

Source link

2024-07-01 11:31:55